Organizational Capability

An Organizational Capability is a system capability that an organizational process.

- AKA: Organizational Skill.

- Context:

- It can be measured by an Organizational Capability Measure.

- It can be supported by a Technical Organizational Capability, a Social Organizational Capability, ...

- It can range from being a Core Capability, to being an Enabling Capability, to being a Supplemental Capability.

- It can be managed by an Organizational Capability Management Task (including organizational capability analysis).

- It can (typically) support Business Processes.

- It can be related to Know-How.

- …

- Example(s):

- enable ePayments, tailor solutions at point of sale, demonstrate product concepts with customers, combine elastic and non-elastic materials side by side.

- manage an order, manage a sale, configure product pricing, manage a contract, qualify a prospect, and conduct business intelligence.

- a Project Management Capability.

- an IT Capability.

- a Data Management Capability.

- a Business Intelligence Capability, which can include a Data Science Capability.

- a Personalization Capability.

- an Experimentation Capability.

- Supply Chain Management Capability - ability to coordinate and integrate cross-enterprise supply chain processes.

- Customer Service Capability - ability to consistently deliver excellent customer service and customer support.

- Innovation Capability - ability to continuously innovate products, services, and business models.

- Analytics Capability - ability to gather, analyze, and extract insights from data.

- Change Management Capability - ability to effectively lead organizational change.

- Collaboration Capability - ability to foster seamless collaboration across the organization.

- a Functional Organizational Capability (for an organizational function).

- an Organization-Specific Capability, such as:

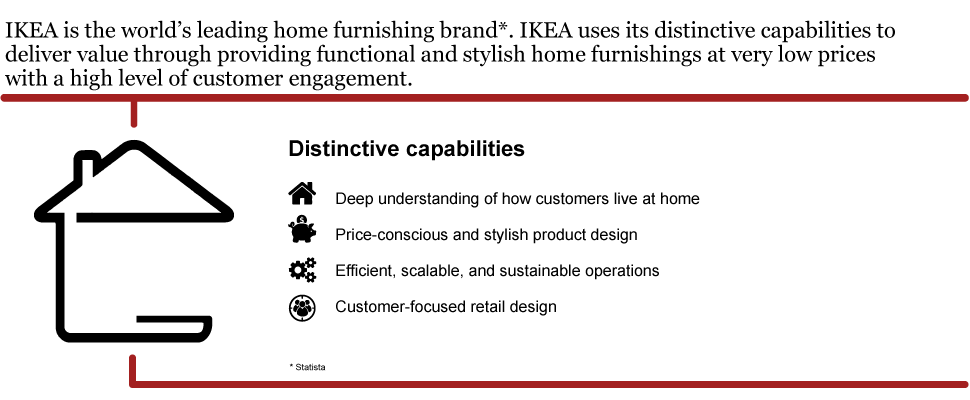

- an IKEA Capability, such as:

, from (Leinwand et al., 2016).

, from (Leinwand et al., 2016). - a PlayStation Capability.

- ...

- an IKEA Capability, such as:

- …

- Counter-Example(s):

- See: Organizational Learning, Core Competence.

References

2020

- (Wikipedia, 2020) ⇒ https://en.wikipedia.org/wiki/Capability_management_in_business Retrieved:2020-4-2.

- Capability management is the approach to the management of an organization, typically a business organization or firm, based on the “theory of the firm” as a collection of capabilities that may be exercised to earn revenues in the marketplace and compete with other firms in the industry. “Capability Management" seeks to manage the stock of capabilities within the firm to ensure its position in the industry and its ongoing profitability and survival.

Prior to the emergence of capability management, the dominant theory explaining the existence and competitive position of firms, based on Ricardian economics, was the resource-based view of the firm (RBVF). The fundamental thesis of this theory is that firms derive their profitability from their control of resources – and are in competition to secure control of resources. Perhaps the best-known exposition of the Resource-based View of the Firm is that of one of its key originators: economist Edith Penrose. "Capability management" may be regarded as both an extension and alternative to the RBVF that asserts that it is not control over physical resources that is the basis for firm profitability but that "Companies, like individuals, compete on the basis of their ability to create and utilize knowledge;...". [1] In short, firms compete not on the basis of control of resources but on the basis of superior Know-How. This Know-How is embedded in the capabilities of the firm – its abilities to do things that are considered valuable (in and by the market).

- Capability management is the approach to the management of an organization, typically a business organization or firm, based on the “theory of the firm” as a collection of capabilities that may be exercised to earn revenues in the marketplace and compete with other firms in the industry. “Capability Management" seeks to manage the stock of capabilities within the firm to ensure its position in the industry and its ongoing profitability and survival.

2020

- (Wikipedia, 2020) ⇒ https://en.wikipedia.org/wiki/Capability_management_in_business#Types_of Retrieved:2020-4-2.

- Leonard defines three types of business capability that a firm might possess: Core Capabilities, Enabling Capabilities and Supplemental Capabilities. Core Capabilities are defined as those "built up over time", that "cannot be easily imitated" and therefore "constitute a competitive advantage for a firm". They are distinct from the other types of capability and sufficiently superior to similar capabilities in competitor organizations to provide a "sustainable competitive advantage". It is implied that such core capabilities are the product of sustained, long organizational learning. Supplemental Capabilities are defined as those that "add value to core capabilities but that could be imitated". Enabling Capabilities are defined as those that "are necessary but not sufficient in themselves to competitively distinguish a company." In other words, enabling capabilities are those which a firm has to do, in support of its normal operations and core capabilities, but which are not themselves core capabilities (because they could be imitated, developed quickly or would not be very different from competitors' capabilities). Enabling capabilities are distinguished from supplemental capabilities in that they are required, but do not necessarily add value to core capabilities. A business capability is what a company needs to do to execute its business strategy (e.g., enable ePayments, tailor solutions at point of sale, demonstrate product concepts with customers, combine elastic and non-elastic materials side by side, etc.).

Another way to think about a capability is that it is an assembly of people, process and technology for a specific purpose. [2]

Capability Management is the active management, over time, of the portfolio of capabilities in a firm – their development and depreciation in conscious response to changes in the business environment.

Capability management is an approach that uses the organization's customer value proposition to establish performance goals for capabilities based on value contribution. It helps drive out inefficiencies in capabilities that contribute low customer impact and focus efficiencies in areas with high financial leverage; while preserving or investing in capabilities for growth.

- Leonard defines three types of business capability that a firm might possess: Core Capabilities, Enabling Capabilities and Supplemental Capabilities. Core Capabilities are defined as those "built up over time", that "cannot be easily imitated" and therefore "constitute a competitive advantage for a firm". They are distinct from the other types of capability and sufficiently superior to similar capabilities in competitor organizations to provide a "sustainable competitive advantage". It is implied that such core capabilities are the product of sustained, long organizational learning. Supplemental Capabilities are defined as those that "add value to core capabilities but that could be imitated". Enabling Capabilities are defined as those that "are necessary but not sufficient in themselves to competitively distinguish a company." In other words, enabling capabilities are those which a firm has to do, in support of its normal operations and core capabilities, but which are not themselves core capabilities (because they could be imitated, developed quickly or would not be very different from competitors' capabilities). Enabling capabilities are distinguished from supplemental capabilities in that they are required, but do not necessarily add value to core capabilities. A business capability is what a company needs to do to execute its business strategy (e.g., enable ePayments, tailor solutions at point of sale, demonstrate product concepts with customers, combine elastic and non-elastic materials side by side, etc.).

2008

- (Merrifield et al., 2008) ⇒ Rick Merrifield, Jac Calhoun, and Dennis Stevens. (2008). “The Next Revolution in Productivity." Harvard Business Review, Jun 1;86(6):72.

- QUOTE: … The first step involves drawing a diagram of the activities, capabilities, and subcapabilities in your business. Collaborating with the people who run a particular area of the business, you should describe its operation in terms of outcomes or fundamental purposes. This is easier said than done because people are used to describing the work they do (“We send a customer an invoice that requests on-time payment”) and how they do it (“We check the order against our invoice. Then we call the customer to ask who should receive the invoice and how we should send it. On the due date, we check to see whether we have been paid.”). They are not accustomed to talking about its fundamental purpose or outcome (“bill customer” or “collect customer payment”).

The next task is to describe the crucial capabilities that support most of your business activities, including all the key ones. For the area “generate demand,” the managers at one financial services firm listed three activities: manage partner relationships, market products and services, and sell products and services. We then asked them what capabilities supported each. They came up with seven, for instance, for sell products and services: manage orders, manage sales, manage immediately filled sales, configure product pricing, manage contracts, qualify prospects, and conduct business intelligence. In all, it took about three weeks to define the entire company’s capabilities and subcapabilities.

There are three basic criteria for determining which activities are most important to your business, which have underlying capabilities that need to be improved, and which are candidates to become web services …

- QUOTE: … The first step involves drawing a diagram of the activities, capabilities, and subcapabilities in your business. Collaborating with the people who run a particular area of the business, you should describe its operation in terms of outcomes or fundamental purposes. This is easier said than done because people are used to describing the work they do (“We send a customer an invoice that requests on-time payment”) and how they do it (“We check the order against our invoice. Then we call the customer to ask who should receive the invoice and how we should send it. On the due date, we check to see whether we have been paid.”). They are not accustomed to talking about its fundamental purpose or outcome (“bill customer” or “collect customer payment”).

2004

- (Ulrich & Smallwood, 2004) ⇒ Dave Ulrich, and Norm Smallwood. (2004). “Capitalizing on Capabilities.” In: Harvard Business Review, June 2004.

- QUOTE: ... These capabilities — the collective skills, abilities, and expertise of an organization — are the outcome of investments in staffing, training, compensation, communication, and other human resources areas. They represent the ways that people and resources are brought together to accomplish work. They form the identity and personality of the organization by defining what it is good at doing and, in the end, what it is. They are stable over time and more difficult for competitors to copy than capital market access, product strategy, or technology. They aren’t easy to measure, so managers often pay far less attention to them than to tangible investments like plants and equipment, but these capabilities give investors confidence in future earnings. Differences in intangible assets explain why, for example, upstart airline JetBlue’s market valuation is twice as high as Delta’s, despite JetBlue’s having significantly lower revenues and earnings. ...