Financial Crisis of 2007-2008

(Redirected from late-2000s financial crisis)

Jump to navigation

Jump to search

A Financial Crisis of 2007-2008 is a financial crisis/banking crisis that occurred between 2007 and 2008.

- Context:

- It can be a cause of a Late-2000s Global Recession.

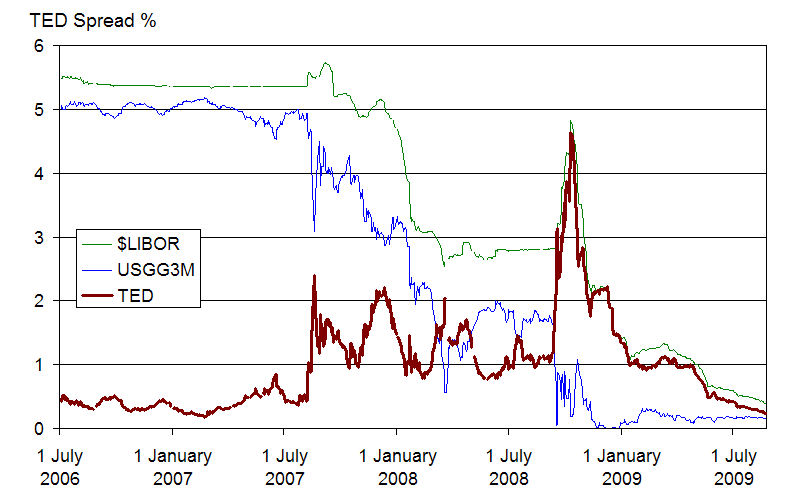

- See: European Sovereign-Debt Crisis, 1930s Great Depression, Subprime Mortgage, Banking Crisis, Government Financed Bailout, World Financial System, Economic Downturn, TED Spread.

References

2020

- https://www.foreignaffairs.com/articles/united-states/2020-08-06/coronavirus-depression-global-economy

- QUOTE: ... Although dubbed a “global financial crisis,” the downturn that began in 2008 was largely a banking crisis in 11 advanced economies. Supported by double-digit growth in China, high commodity prices, and lean balance sheets, emerging markets proved quite resilient to the turmoil of the last global crisis. …

2017

- (Wikipedia, 2017) ⇒ https://en.wikipedia.org/wiki/Financial_crisis_of_2007–2008 Retrieved:2017-11-27.

- The financial crisis of 2007–2008, also known as the global financial crisis and the 2008 financial crisis, is considered by many economists to have been the worst financial crisis since the Great Depression of the 1930s. It began in 2007 with a crisis in the subprime mortgage market in the US, and developed into a full-blown international banking crisis with the collapse of the investment bank Lehman Brothers on September 15, 2008. Excessive risk-taking by banks such as Lehman Brothers helped to magnify the financial impact globally. Massive bail-outs of financial institutions and other palliative monetary and fiscal policies were employed to prevent a possible collapse of the world financial system. The crisis was nonetheless followed by a global economic downturn, the Great Recession. The European debt crisis, a crisis in the banking system of the European countries using the euro, followed later. The Dodd–Frank Act was enacted in the US in the aftermath of the crisis to "promote the financial stability of the United States". The Basel III capital and liquidity standards were adopted by countries around the world.