TED Spread

Jump to navigation

Jump to search

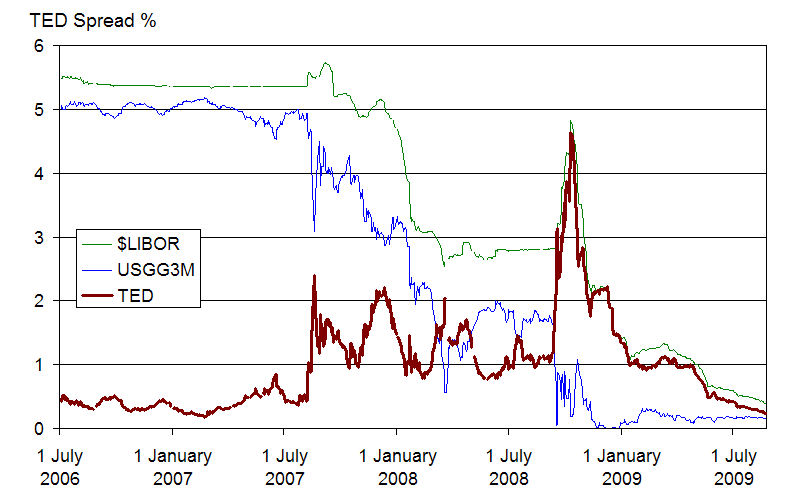

A TED Spread is a difference measure between interbank loans interest rates and short-term U.S. government debt.

- See: Futures Contract, U.S. Treasury Bill, Eurodollar, Treasury Security, London Interbank Offered Rate, Chicago Mercantile Exchange, Financial Crisis of 2007-2008.

References

2017

- (Wikipedia, 2017) ⇒ https://en.wikipedia.org/wiki/TED_spread Retrieved:2017-11-27.

- The TED spread is the difference between the interest rates on interbank loans and on short-term U.S. government debt ("T-bills"). TED is an acronym formed from T-Bill and ED, the ticker symbol for the Eurodollar futures contract.

Initially, the TED spread was the difference between the interest rates for three-month U.S. Treasuries contracts and the three-month Eurodollars contract as represented by the London Interbank Offered Rate (LIBOR). However, since the Chicago Mercantile Exchange dropped T-bill futures after the 1987 crash, [1] the TED spread is now calculated as the difference between the three-month LIBOR and the three-month T-bill interest rate.

- The TED spread is the difference between the interest rates on interbank loans and on short-term U.S. government debt ("T-bills"). TED is an acronym formed from T-Bill and ED, the ticker symbol for the Eurodollar futures contract.

2017b

- (Wikipedia, 2017) ⇒ https://en.wikipedia.org/wiki/Financial_crisis_of_2007–2008 Retrieved:2017-11-27.