Employee Stock Purchase Plan (ESPP)

An Employee Stock Purchase Plan (ESPP) is an employee incentive benefit that allows participating employees to buy their company stock at a discount.

- Example(s):

- Counter-Example(s):

- See: Company Stock, Employee Stock Ownership, Shareholder, Stock Market.

References

2023

- (ChatGPT-OpenAI, 2023) ⇒ https://chat.openai.com/chat Retrieved:2023-4-9.

- Q: What is an employee stock purchase plan (ESPP)?

- A: An employee stock purchase plan (ESPP) is a type of benefit plan offered by some employers that allows employees to purchase company stock at a discounted price.

Through an ESPP, employees can contribute a percentage of their salary to purchase company stock on a regular basis. The employer may offer a discount on the stock price, typically up to 15%, as an incentive for employees to participate in the plan.

The ESPP is often structured as a tax-advantaged plan, which means that employees may be able to purchase the stock with pre-tax dollars or receive favorable tax treatment on the purchase or sale of the stock.

ESPPs can be a valuable benefit for employees, as they allow them to participate in the growth of their company and potentially earn a profit if the stock price increases. However, like all investments, there is also a risk that the stock price may decrease, resulting in a loss for the employee. It's important for employees to carefully consider the risks and benefits of participating in an ESPP and to consult with a financial advisor if necessary.

2022

- (Wikipedia, 2022) ⇒ https://en.wikipedia.org/wiki/Employee_stock_purchase_plan Retrieved:2022-10-6.

- In the United States, an employee stock purchase plan (ESPP) is a means by which employees of a corporation can purchase the corporation's capital stock, often at a discount. Employees contribute to the plan through payroll deductions, which build up between the offering date and the purchase date. At the purchase date, the company uses the accumulated funds to purchase shares in the company on behalf of the participating employees. The amount of the discount depends on the specific plan but can be around 15% lower than the market price. ESPPs can also be subject to a vesting schedule, or length of time before the stock is available to the employees, typically one or two years of service.

Depending on when the employee sells the shares, the disposition will be classified as either qualified or not qualified. If the position is sold two years after the offering date and at least one year after the purchase date, the shares will fall under a qualified disposition. If the shares are sold within two years of the offering date or within one year after the purchase date the disposition will not be qualified. These positions will have different tax implications.

ESPPs differs from other types of employee stock ownership, such as Employee Stock Ownership Plans (ESOPs), both in how the stocks are bought, access to the stocks (either after vesting or upon retirement), taxation for the employees, and how much these plans cost to implement for the company.

The majority of publicly disclosed ESPPs in the United States are tax-qualified plans that follow the rules of Section 423 of the IRC.

Participation rates in the US in ESPPs is around 30%.[1]

- In the United States, an employee stock purchase plan (ESPP) is a means by which employees of a corporation can purchase the corporation's capital stock, often at a discount. Employees contribute to the plan through payroll deductions, which build up between the offering date and the purchase date. At the purchase date, the company uses the accumulated funds to purchase shares in the company on behalf of the participating employees. The amount of the discount depends on the specific plan but can be around 15% lower than the market price. ESPPs can also be subject to a vesting schedule, or length of time before the stock is available to the employees, typically one or two years of service.

- ↑ Babenko, Ilona; Sen, Rik (March 14, 2014). “Money Left on the Table: An Analysis of Participation in Employee Stock Purchase Plans". Review of Financial Studies. 27 (12): 2. doi:10.1093/rfs/hhu050. SSRN 2166012.

2022

- Slavik Lozben. (2022). “Best Investment Ever, No BS." In: Medium

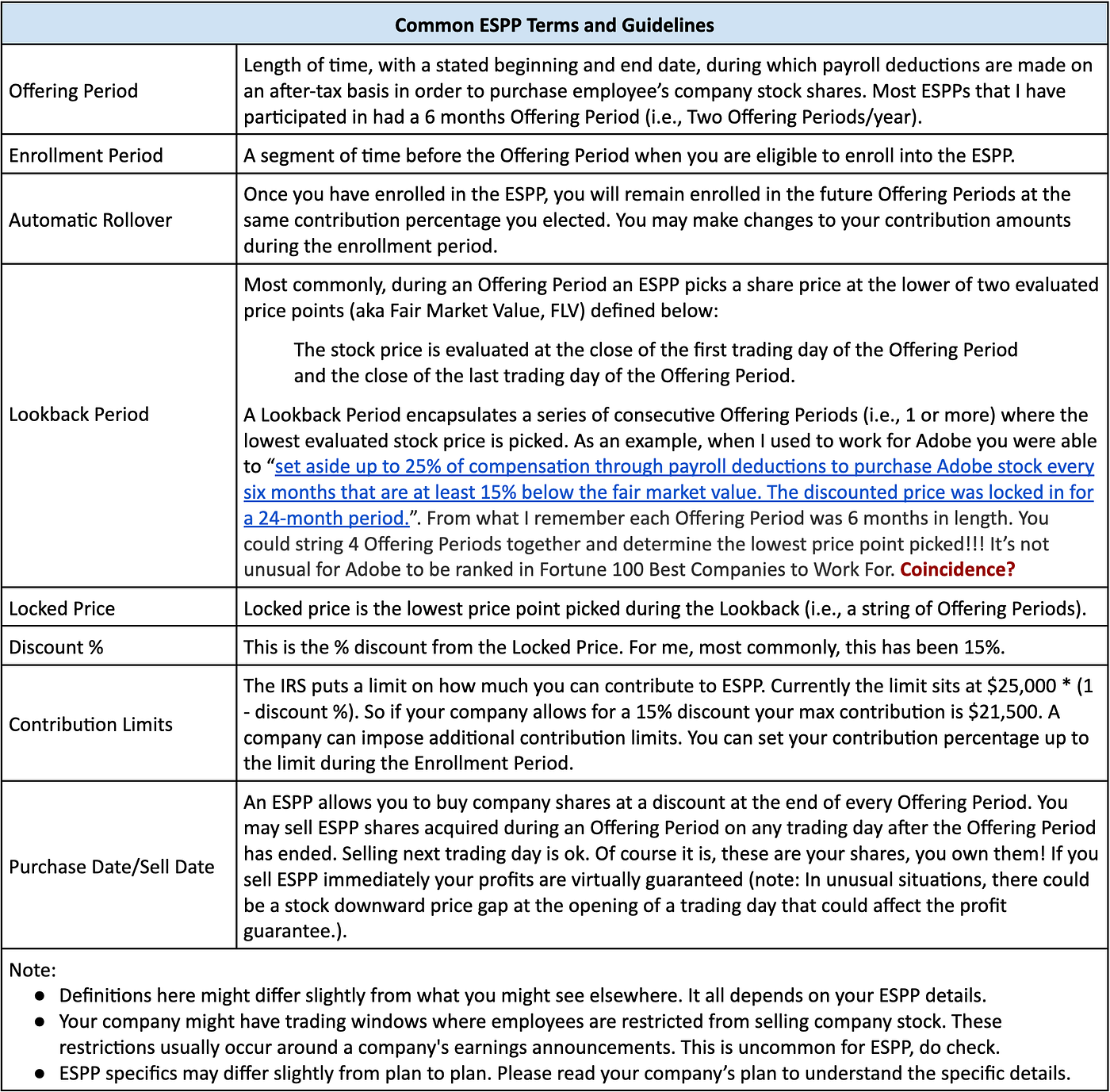

- QUOTE: ... Employee Stock Purchase Plan (ESPP) is a company-run program which allows participating employees to buy their company stock at a discount. Employees contribute to the program via their paycheck deductions. There are specific guidelines to every ESSP (ex. dollar amount you are able to buy and at what price, dates when you are able to sell). Below are some of the common ESPP terms and guidelines:

>

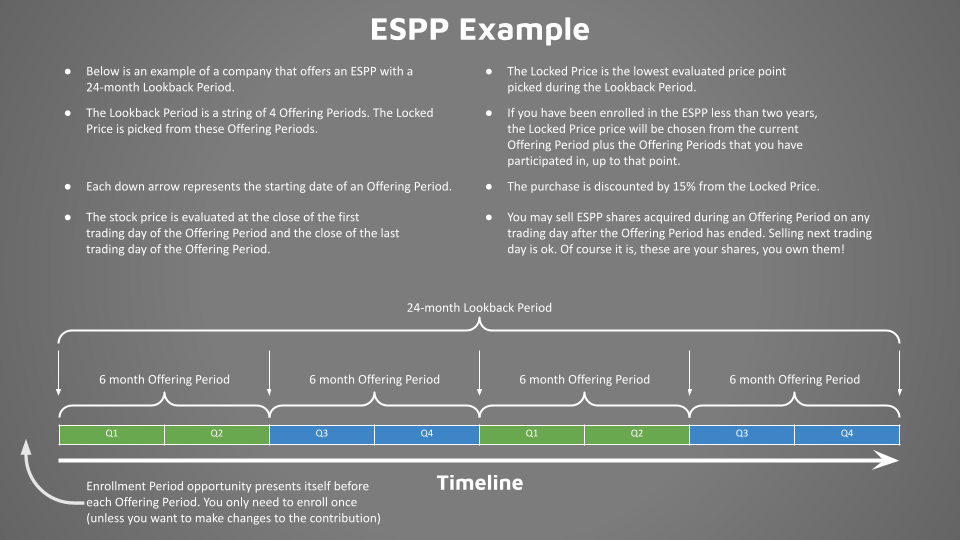

>